Your small business is poised for major growth — but how will you get there? In part 6 of this 50-minute class, Bond Street CEO David Haber explains how to prepare for a business loan.

Watch Part 7: How to Apply for a Business Loan Online

A Closer Look at How to Prepare for a Small Business Loan

As busy small business owners, we don’t celebrate milestones enough. While the world may not know about the important steps you took before officially launching your business, you know the many joys and struggles that preceded the “start” of your company.

Financing works the same way. Getting the first small business loan disbursement in your bank account may seem like the only milestone worth celebrating, but mastering the application process is itself a significant victory. And, just like becoming profitable has a lot to do with that pre-launch work, getting good terms on a small business loan has a lot to do with how well you’ve prepared to apply.

Step 1: Credit Score

The process of preparing for a small business loan starts even before we become business owners. Lenders care about your personal credit score. How you handle a car loan or credit card debt now reflects how you might manage a $100,000 small business loan in the future. If you hope to get a small business loan one day, the very first thing to do is analyze your credit now. You can boost your score by disputing errors on your credit report (they’re more common than you might think!), keeping your outstanding balance low, and keeping your utilization rate (the percentage of available credit you’re using) under 10%.

Your business credit score is, of course, also important to lenders. If you haven’t separated your business and personal finances, do so ASAP. (It’s a headache at first, but we promise you’ll thank us later.) Then apply the same principles to your business credit that you used to analyze your personal credit.

Dig Deeper:

- Your Personal Credit Score: The Rundown

- How to Access Your Personal Credit Score

- Your Business Credit Score: What is It?

- How to Raise Your Credit Score

Step 2: How Much Do I Need to Borrow and How Much Debt Can My Business Afford?

Once your credit score is taken care of, it’s time to analyze your use case. Small business loans are meant to meet very specific needs. A good lender will not give you a loan for a financing need better met by credit cards or angel investors. Nor do they want to see your business squashed under the weight of an oversize loan. That’s why they study your financial statements and calculate your debt service coverage ratio, or DSCR. If you do this same process with a help of an accountant before applying, you can make a very compelling case for why you need the amount you’re requesting and why you can be trusted to pay it back. All the lender will have to do is double-check your math and send you the offer!

Dig Deeper:

- Application Checklist: Questions for Your Accountant

- What is Debt Service Coverage Ratio? [Template Included]

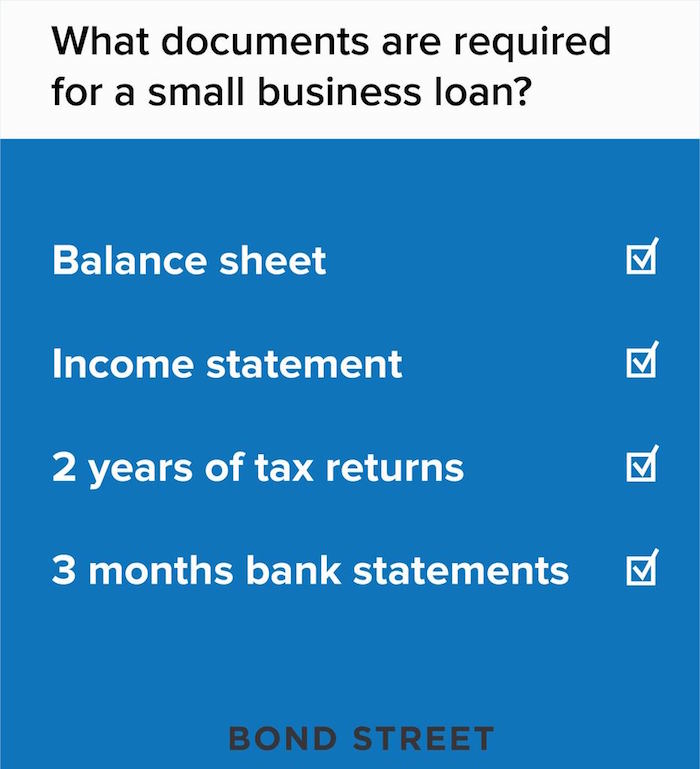

Step 3: What Information and Documents Will I Need to Complete the Application?

Lenders vary in terms of what information they require from a borrower, however there are certain documents that will almost unanimously be required for a small business loan. At Bond Street, we require the following documents.

Dig Deeper:

- A Quick Guide to Financial Statements

- Bond Street Loan Application Checklist

- A Step-By-Step Guide to Applying for a Bond Street Loan

Your journey isn’t over when you get that first small business loan offer. Make sure you understand it! Understanding of the difference between interest rates and APR will make you a true master of small business loans. With that knowledge in hand, you can compare offers and understand exactly how much a loan is going to cost you by the time you’ve paid it off. Don’t accept a loan just because it’s been offered. You’re in charge of your business finances. By understanding what’s best for your small business, you can partner with people who will really help you succeed—and celebrate each milestone along the way.

At Bond Street, we believe financing a business should be simple, transparent, and fair. Reach out today or check your own rate in less than a minute.

Get Started