When you’re shopping around for a small business loan, you may feel puzzled, totally freaked out, or perhaps even eternally doomed.

You may have even considered abandoning your dreams of growing your labor of love to avert the seemingly endless, jargon-infused options that live on the World Wide Web.

But don’t give up just yet. We put together a guide to explain one of the most common forms of small business financing: a term loan.

OK, we know what you’re thinking: another article that promises me the solution to my funding woes, but in reality, reads like a college accounting textbook and leaves me even more confused than before (if that’s possible).

But, we’re asking you to trust us.

Maybe we’re biased, but this guide is useful, and we would even go so far as to say it’s pretty great. So buckle up, here’s what you have to look forward to:

- What is a Term Loan?

- Why Term Loans

- What Should You Use a Term Loan For?

- How Does a Term Loan Work?

- When a Term Loan May Not Be Right

- Applying for a Term Loan

- Evaluating Your Term Loan Offer

- How Much Can My Business Afford

- Term Loan FAQ’s

There’s a lot to learn. Let’s dig in, shall we?

What is a Term Loan?

If you’ve ever taken out a student loan, mortgage, or an auto loan, you already have some experience with term loans (Disclaimer: Ignore any of your negative associations with the above).

Term Loan Definition

A term loan is a lump sum (the “loan amount”) borrowed from a lender and paid off at fixed intervals (weekly, bi-weekly, monthly) over a set period of time (or “term”). Simple enough, right?

If you want to dig deeper on what a term loan is (and isn’t), watch the following video. If not, feel free to skip and keep on reading.

Why Term Loans?

There are a number of reasons that term loans are a fan-favorite among business owners.

- Lower Interest Rates: Due to their longer durations, term loans are typically available at lower interest rates than shorter-term loans.

- Allows operational cash flow to be used elsewhere: You know your business best, and term loans let you put your money to work where you see fit. Term loans give the borrowing business the ability to use their cash flow in other areas, while the loan provides the funding needed for larger investments in the business.

- Set payment structure: As a small business owner, there’s enough things in your life that you can’t predict: a no-show at work, a POS system crash (with a line of 20 angry customers, no less), a natural disaster—the list goes on. A term loan provides you with much more than just cash; it delivers peace of mind. A repayment schedule is set in stone when you sign your offer, no takebacks! Your budget will thank you.

- Simple, streamlined application process: Applying for a term loan is quick—like 3 days quick. Let’s put this into perspective: When you apply for a loan with a bank, you’ll likely be waiting six to eight weeks—at minimum. The application process is manual and labor-intensive, and the answer is quite often: “No”. With a term loan, you can fill out an application from the comfort of your couch within 10 minutes.

- Business advantages: While we’re at it, we may as well toss a few other bonuses into the mix. First, the interest of a term loan is tax-deductible. So when it comes to that time of the year, you’ll be getting some extra cash back. Second, making payments on time boosts your business credit score, which translates to future financing opportunities at lower interest rates.

- You’re the boss: Chances are, if you started your own business, you didn’t do so to have to compromise on your vision. But, when you give up a stake of your business for equity, your control inevitably becomes diluted. Since a term loan is a form of debt financing, you aren’t sacrificing anything: ownership stays 100% with you.

Small business financing is complicated. We made it simple.

What Should You Use a Term Loan For?

Offering lower interest rates than credit cards, a term loan makes investments in long-term business growth possible.

But you know what else?

Term loans provides ample time for your investment – such as a new location or upfront purchase of inventory – to begin to make a contribution back to the business before the loan matures.

However, using a term loan to cover a cash shortage when you don’t expect business growth in the near future, or using one to cover an expense you expect to repay in a few weeks, may drag down, rather than boost your business.

This is why analyzing ROI (return on investment) is crucial.

Think about it this way:

If you deploy the funds you raise toward an expense that will generate growth or revenue, the investment will have a positive return on investment.

If you deploy the funds you raise toward an expense that will not generate revenue—such as repainting your office walls—you will have a negative return on investment.

Do you see where we’re going with this?

This is why a term loan is meant to be used for a specific purpose.

Term Loan Examples

Here are a few real-life examples of term loans in action:

Invest in inventory, equipment or a new location: Have you been considering investing in new equipment to boost your business?

Maybe you realized that you can unlock discounts or higher-quality suppliers when you buy raw material in bulk. If you don’t have enough the cash on hand to cover upfront costs (or a down payment on a great space), a term loan could be the answer.

After successfully opening 10 coffee shops using a combination of sales revenue and investments from friends and family, Jonathan Rubinstein of Joe Coffee used a term loan to open his 11th and 12th outposts.

Bring on new hires: Could you use additional staff to prepare for the seasonal uptick in business? Or, have you been putting off making a much-needed hire?

High Tide—a New York-based creative agency behind noteworthy brands like Warby Parker and Casper—utilized a term loan to fill a few roles, including adding an “invaluable” account manager.

Expand your offerings: Do you have an idea for a new product or service that could boost your bottom line?

Minneapolis-based fashion brand Hackwith Design was launched in 2013 with a series of limited-edition pieces released every Monday. Soon enough, the company had expanded to include swim, basics and plus-size in its lineup. When Lisa Hackwith and Erin Husted were gearing up to produce the inaugural bridal line, which “took a lot of upfront investment”, they used a term loan to fill the gap.

Try something new: The beauty of entrepreneurship is the ability to pursue your passion. However, sometimes you may lack excess cash to take advantage of these once-in-a-lifetime opportunities.

Tony Gardner is the founder of Alterian, an effects studio for music, film, and television (he also is behind the creation of those famous Daft Punk helmets). Wanting to try different projects than those supported by paying clients, Gardner used a term loan to branch out and try things that wouldn’t have otherwise been possible (including a recent PSA spot produced with Katy Perry).

Avoid a cash flow crunch: As the saying goes: cash is king.

And when Matt Gallira and Jimmy Warren needed funds to gear up for Big Mozz’s opening season at Smorgasburg, the mozzarella mavens turned to a term loan which “allowed them to breathe”.

Refinance debt: Don’t let expensive credit card debt wear you down.

Bec Brittain—the designer behind premium light sculptures—was charging the costs of materials to her personal credit card, which meant her interest rates were getting out of hand. Worried about the bills and looking to refinance, she applied for a term loan. Now, she is able to focus on what matters most: her craft.

How Does a Term Loan Work?

The basic mechanics of term loans are simple: you receive the lump sum upfront (minus any fees charged by the lender). You’re then responsible for repaying the loan amount in full over the period of the term, plus interest.

But, remember: term loans aren’t one-size-fits-all and it’s important to understand what your financing options are.

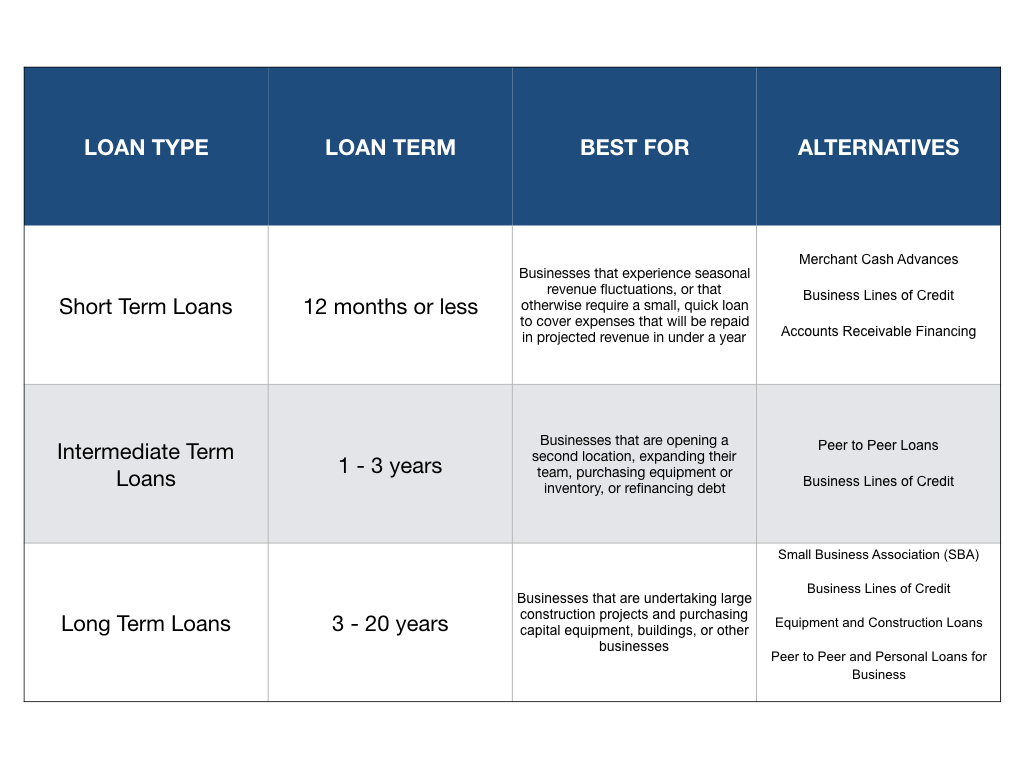

Types of Term Loans

How to Pick the Right Term Loan for Your Business

When choosing the length of a loan, the first thing you should do is calculate how long it will take for the asset being financed to provide a return, and to choose the type of loan accordingly.

Here’s what you’re working with:

- A short-term loan is usually an unsecured sum to be repaid within a year in larger, often daily payments. Remember: Because these are easier to obtain and have (much) higher interest rates than longer-term loans, you should only seek short-term funding for expenses you will immediately receive the cash flow to pay off. We can’t stress this enough.

- Intermediate-term loans are perfect for opening a new location, expanding your team, purchasing equipment or inventory, and refinancing debt. Generally, intermediate-term loans are repaid directly from the asset they were used to finance on a bi-weekly or monthly basis. Intermediate-term loans allow time for an investment to begin to increase revenue. For example, using an intermediate-term loan to finance hiring a new employee funds the time it takes for the business to train the employee and for the employee to gain skills, experience and momentum until they bring in enough revenue not just to to substantiate the hire, but also to help continue to grow the company.

- Long-term loans are always collateralized and run from 3 to 10 (or sometimes 20) years. They are most appropriate for undertaking large construction projects and purchasing capital equipment, buildings, or other businesses. While long-term loans tend to offer lower interest rates, lenders usually only extend long-term loans to the most qualified borrowers. So unless you’ve got a few years under your belt and an A+ application, obtaining this type of term will prove to be a bit more difficult.

But, that’s not all.

There are a few other things to keep in mind when it comes to choosing your terms.

Features of Term Loan: Other Considerations

Some things to consider as you weigh your options include:

- Secured vs. Unsecured Term Loans: Secured loans are protected by an asset or collateral. For example, the bank may hold legal ownership over your assets until all debts are paid. Unsecured loans are not protected in this way, and as a result, involve greater risk for the lender. For this reason, unsecured loans typically have higher costs and shorter repayment terms for the borrower.

- Fixed vs. Variable Interest Rate: A fixed interest rate is just that–once the rate is set by the lender, it doesn’t change. A variable rate, on the other hand, can increase or decrease over time. Variable interest rates are tied to an index or benchmark rate, such as the prime rate. The primary benefit of choosing a fixed interest rate is predictability. You have no guesswork when it comes to your payments. However, variable rate loans tend to have a lower starting point than their fixed rate counterparts. And if there are no significant changes in the prime rate, you may pay less in interest than you would if you opted for a fixed rate instead. However, it’s a bit like Russian Roulette. There’s the possibility that your payment could substantially increase if your rate were to go up. A jump of several hundred dollars in your monthly payments may leave your business stretched thin financially if you’re unprepared. The other pitfall is the risk of paying more in interest on what you borrow if your rate were to increase.

At this point, you’re likely thinking: “Okay, I get it”.

But you know what else?

Despite a term loan being pretty darn versatile, there are a few instances where it isn’t the best option for your business.

When a Term Loan May Not Be The Right Fit for Your Business

It’s impossible to be everything to everyone.

Here are a few scenarios where an alternative form of financing to a term loan may be a better fit:

- If you’re a startup or new business: A term loan should enhance business operations without placing undue pressure on cash flow. With that in mind, a key component of a lender’s underwriting process is analyzing business financials to verify that the cash generated will be able to support the loan payments. Without access to financials over a meaningful period of time, the accuracy of any financial projections is limited. One to two years is typically enough time to build a prospective lender’s confidence in your ability to manage and guide the growth of your business. Putting this in simpler terms, if you haven’t been in business for at least a year, a term loan isn’t for you.

- If you have poor credit: When you apply for a term loan with less-than-satisfactory credit, you’ll face high interest rates—if you qualify at all. Lenders use both your personal and business credit score to evaluate how risky you are as a borrower. And while there is no quick fix for repairing your credit, adopting a few conscious practices can get you there with time. Check out these tips to help boost your score.

By now you’ll have realized whether a term loan will work for your business.

With this in mind, let’s walk through the process of applying (and getting approved) for a term loan—at the best rate. Ready?

No obligation. No effect on your credit score. Nothing to lose.

Applying for a Term Loan

Here’s the deal: cost is (obviously) one of the most important considerations when applying for a term loan. At Bond Street, our interest rates start at 6%, however starting rates vary by lender.

So, what’s the bottom line?

As you’re vetting potential lenders, pay close attention to the APR they’re offering. Rates can go as high as 30% for a term loan, and this number directly impacts the cost of borrowing over the long term. If you’re applying for a short-term loan, such as a Merchant Cash Advance, your APR can skyrocket over 100% (Note: some lenders do not quote in terms of APR, so you’ll want to make use of an online APR calculator to evaluate the true cost of the loan).

Once you’ve decided on your potential partners, it’s time to get ready for the application process.

First Off: Get Your Business and Personal Credit in Check

Anyone who needs to gauge how responsible you are financially checks your credit score.

When you’re applying for a term loan, lenders will check both your personal and business credit score (if you aren’t familiar with your business credit, you aren’t alone: more on that here). For personal credit, your FICO and Vantage scores come into play. When it comes to your business credit score, it’s calculated by three companies: Experian, Equifax and Dun & Bradstreet.

The minimum personal and business credit scores you’ll need to qualify for a loan vary from depending on the lender. At Bond Street, for example, we prefer applicants to have a personal credit score of at least 600.

Before you apply, remember to scan your personal credit report for any inaccuracies that may be hurting your score (the IRS make mistakes too). If you do spot an error, reach out to the credit reporting bureau to have that information corrected or removed. If you aren’t sure how to do that, don’t panic: this handy step-by-step guide can help you figure it out.

Remember: Review the Lender’s Minimum Requirements

While your personal and business credit history is an important factor, it’s not the only thing considered when making approval decisions. Any (or all) of the following come into play:

- Your personal and business cash flow

- Personal and business assets

- How long you’ve been in business

- Annual business revenue

- Your business plan

However, what is required truly varies depending on the lender. So, we’ll answer the following two questions with Bond Street’s criteria in mind:

Who Qualifies for a Term Loan with Bond Street?

- At least 2 years of operating history

- At least $200K in annual sales

- Profitable (or a positive net income)

What Do You Need to Apply for a Term Loan?

Requirements vary by lender, but the following are fairly common requirements for a term loan application.

- Tax EIN

- Why it’s needed: A lender uses your EIN to request your tax return transcripts directly from the IRS.

- Tax Returns

- Why they’re needed: Similar to the other documents, your tax returns show how you manage finances. Lenders often require both your personal and business tax returns.

- Balance Sheet & Income Statement

- Why they’re needed: Your balance sheet and income statement paint a more complete financial picture than what we can see based just on your tax records or credit score alone. These documents are indication of how effectively you’re managing your small business and how strong your financial position is.

- Bank Statements

- Why they’re needed: Your bank statements provide lenders with insight into how well you manage the cash coming into your business. If a lender is considering dropping a hefty $100k into your bank account, they need to be sure you’ll be able to manage such a large sum of money, as well as pay back your term loan.

- Debt Schedule

- Why it’s needed: A debt schedule outlines your debt obligations including (but not limited to) loans, leases, contracts and notes payable. This will help a lender determine whether or not you can handle new debt — more on this later.

Curious to see the step by step process for how to apply for a term loan? Tune in.

Now, that you’ve submitted your application, it’s just a matter of time until you receive your offer. And while the journey is almost over, there are still a few things left to discuss (all of which are very important).

“I felt like Bond Street took the time to understand my business and where we were. It wasn’t just about a loan. And that, to me, was important.”

Evaluating Your Term Loan Offer

Between the fine print and a dizzying amount of financial jargon, we don’t blame you for wanting to blindly sign the contract and be done with it.

And as tempting as it may seem to have the paperwork fade into oblivion and the cash in your hand, putting in the time to understand your term loan offer is a must.

Amount:

The first thing you want to review is the amount you’re approved for. Be warned: It’s not uncommon for a lender to approve you for a different amount than what you originally requested. And even more importantly: Don’t freak out. Receiving less than you asked for doesn’t mean it’s a bad deal. You just need to understand how the funds you’ve been approved for can impact your business, and whether it makes sense given the total ROI.

Rate:

It’s important that you hone in on rate—and by rate we mean interest rate, but more importantly, APR—as it reveals how much you’re paying to borrow money.

Repayment Terms (duration):

Paying back a $100k loan over one year is a lot different than paying back a $100k loan over three years. Some institutions allow you to choose from several repayment plans. Perhaps the most important consideration is whether the plan involves paying off your debt in even amounts (allowing you to budget the cost easily) or increasing amounts (allowing you to pay it off more quickly with less interest).

Fees

Fees vary by lender, which is why it’s extra important that you review carefully. Here are some fees that may be tacked onto your offer:

- Origination fee: Like a commission, this is an upfront fee charged by the lender for processing a new loan. The only fee Bond Street charges is a 3-5% origination fee.

- Processing fee: This is a catch-all term for the miscellaneous costs of underwriting a loan that lenders sometimes pass on to the borrower.

- Utilization fee: A lender bases these annual fees on the amount of credit actually used by a borrower [in instances where the loan is drawn down in smaller advances].

- Documentation fee: Some banks charge a documentation fee (in the $100-200 range) for filing a loan application.

- Prepayment fee: Some lenders require premiums based on the percentage of the principal being paid ahead of schedule, especially if the source is refinancing (if allowed).

- Late fee: These fees are charged when payments are not made on time.

- Broker’s fee: Similar to if you’re renting an apartment and get charged a broker’s fee. It is particularly important for small businesses to be careful when using a broker.

- Commitment fee: Some lenders charge this fee, usually a fixed percentage of an undisbursed loan amount, for guaranteeing a loan in the future.

- Closing fee: These are the costs of the lender’s lien on loan collateral. Most institutional term loans do not require closing fees.

If you accept an offer from Bond Street, we’ll give you the full balance of your term loan minus a 3-5% origination fee (which is the only fee we have).

Other Stuff To Keep in Mind

- Personal Guarantee: Lenders often require personal guarantees when granting loans to small business owners. A personal guarantee means you assume personal liability for the debt. The lender will be able to seek legal recourse against you personally, if the business defaults on the loan.

- APR vs. Interest Rate: The interest rate on a loan represents the current rate of borrowing. On the other hand, the APR is the annualized cost of a loan, including all interest payments, fees, and services charges. The APR reflects the true cost of the term loan.

Still feeling a bit lost? The video below walks you through how to make sense of your offer.

How Much Can My Business Afford?

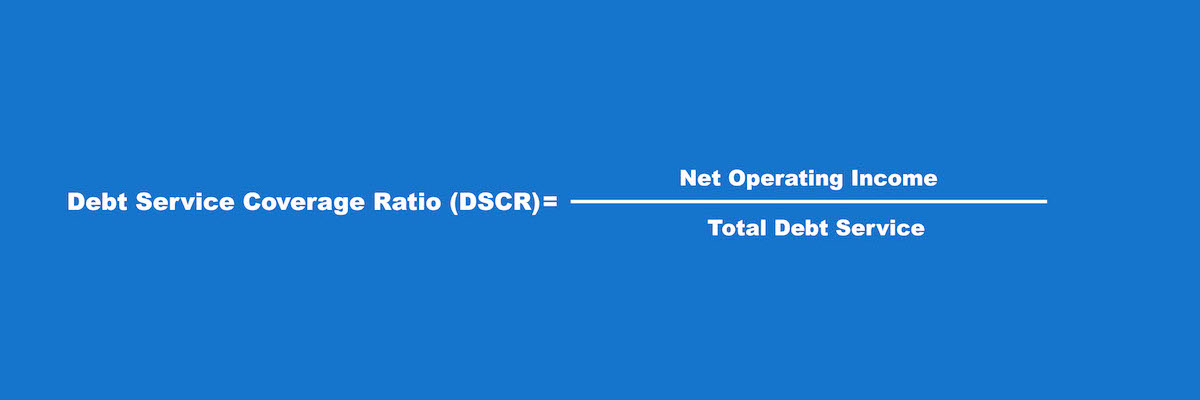

The remaining piece of the puzzle is determining whether your business is in a position to repay the loan. Analyzing your debt service coverage ratio (DSCR), can provide the answer to this question.

I know what you’re thinking: Ratio? Math? This sounds confusing. We promise, it’s far more simple than it sounds.

DSCR is a ratio that compares the amount of cash a business has available to the debt it has taken on. The calculation below will produce your DSCR ratio.

Interpreting DSCR numbers:

| DSCR < 1 | DSCR = 1 | DSCR > 1 |

|---|---|---|

| A DSCR below one means that you don’t have the ability to pay your debts in full. For example a DSCR of .97 means that you only have the ability to pay 97% of your debt obligations. This means you probably should not be borrowing more money. | A DSCR of one indicates that 100% of your business's’ net income is going towards paying your debts. While this is sustainable in theory, it leaves you very vulnerable to any variation in your cash flow. | A DSCR above one means that your business is generating enough income to pay its debts. For example, a DSCR of 1.20 means that you are making 20% more income than you need to cover your debts. |

Lenders are looking not only for a DSCR above 1 (meaning you can repay their loan), but a bit of a cushion to account for any unforeseen circumstances. At Bond Street, we require a DSCR of 1.15 to approve a loan.

Our suggestion is that you use DSCR to evaluate how much you should realistically be borrowing (which we’ve conveniently included below).

How to Get The Best Term Loan Rate

Be Prepared:

Let’s start with the most important thing: get your credit in order. You don’t need perfect credit to qualify for a term loan but it’s helpful to know where you stand. And, if your score isn’t quite there, you may want to consider holding off on an application. While boosting your credit isn’t exactly fun, it can result in a much more affordable rate.

Be Realistic:

As Bond Street’s very own Jamie Shulman shares, “Oftentimes we speak to applicants who believe our loan will give them the power to grow X%, however without real data, we must temper their expectations given the concrete historical financials we have. If a business has only grown 10% or 20% for the past three years, we will need verification to agree with an owner’s assumptions of 50% growth going forward.” You need to be able to backup your aspirations with factual evidence.

Be Specific:

As we mentioned earlier, term loans are meant to serve specific use-cases. However, saying “I want to hire some employees” is not enough. “The more specific the better when detailing your use case, especially for larger dollar loans. We want to see that you put thought into the requested amount and that it is reasonable given your business’s financial state and its goals,” explains Shulman. Taking the time to not only iron out the details of your investment, but the expected ROI on such an asset will help your case.

Term Loan FAQs & Common Concerns

At Bond Street, we believe financing a business should be simple, transparent, and fair. Reach out today or check your own rate in less than a minute.

Get Started