Why calculating the Debt Service Coverage Ratio (DSCR) is important:

The Debt Service Coverage Ratio (a mouthful we and others abbreviate as DSCR) is an important metric for small business owners who have borrowed or plan to borrow money.

We’ll walk you through why lenders care about DSCR, how to calculate it for small businesses, and what the ratio means for your ability to qualify for a loan.

Why do lenders care about DSCR?

DSCR is the way lenders evaluate the capability of your business to pay back their loan. They want to be certain that you have sufficient regular cash flow over the term of the loan to make your monthly payments. It’s also important way for you to evaluate the financial health of your small business.

What the DSCR means:

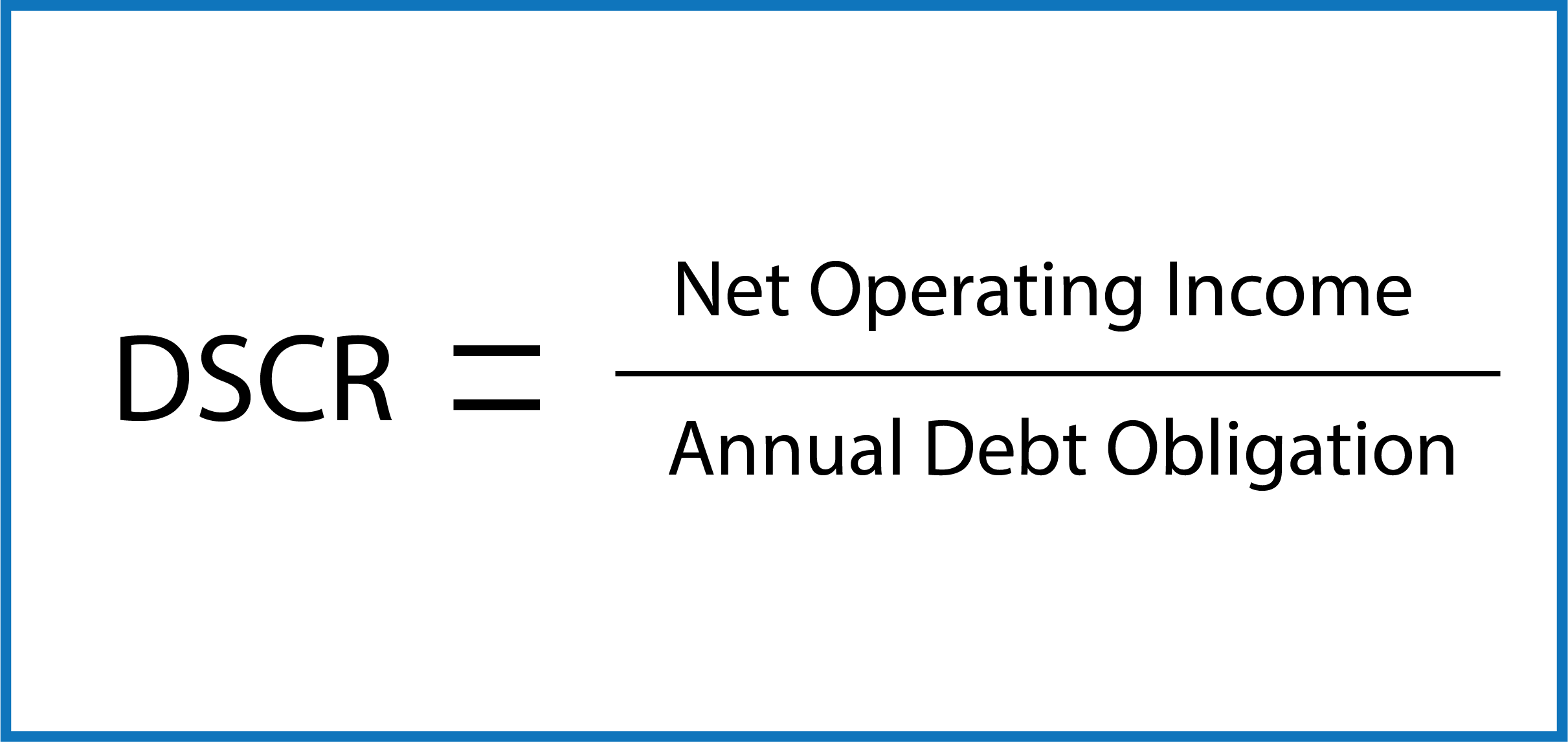

DSCR is a ratio that compares the amount of cash a business has available to the debt it has taken on.

In plainer english, DSCR compares your current financial performance and plans for growth against your expenses and any debt you might owe.

| Net Operating Income | Annual Debt Obligation |

|---|---|

| Your Net Operating Income is the revenue from your business minus your cost of goods sold (COGS) and you ooperating expenses. Operating expenses do not need to include taxes, interest payments, depreciation, and amortization. | Your Annual Debt Obligation is the current year’s payments of loan principal, loan interest, loan fees, and, if applicable, lease payments. This includes payments on all business obligations that you currently have and the loan you’re applying for. |

Interpreting DSCR numbers:

The calculation above will produce your DSCR ratio:

| DSCR < 1 | DSCR = 1 | DSCR > 1 |

|---|---|---|

| A DSCR below one means that you don’t have the ability to pay your debts in full. For example a DSCR of .97 means that you only have the ability to pay 97% of your debt obligations. This means you probably should not be borrowing more money. | A DSCR of one indicates that 100% of your business's’ net income is going towards paying your debts. While this is sustainable in theory, it leaves you very vulnerable to any variation in your cash flow. | A DSCR above one means that your business is generating enough income to pay its debts. For example, a DSCR of 1.20 means that you are making 20% more income than you need to cover your debts. |

What DSCR do lenders require?

Lenders are looking not only for a DSCR above 1 (meaning you can repay their loan), but some degree of cushion above that to account for uncertainty).

The exact value that lenders are looking for depends on the specific lender and the general economic climate — lenders become more risk averse when the broader economy is not doing as well.

At Bond Street, we require a DSCR of 1.15 to approve a loan.

Calculating your own DSCR:

If you plan on applying for a loan, calculating your DSCR will help you determine the loan amount that’s best for your business.

Calculating your DSCR in advance shows your prospective underwriter that you understand the fundamentals behind the loan they might provide and how it will impact your business. It’s also an important metric to track in general to understand the health of your business.

Getting to it:

DSCR example:

As an example, a business with net income of $100,000 and an annual debt obligation of $50,000 has a DSCR of 2. This means this hypothetical business’s net income can cover its debt obligations twice over — they’re doing great!

What if my DSCR isn’t as high as I need?

To improve your DSCR, you need to improve your business fundamentals: increase your revenues and lower your expenses, or lower the amount of debt that you have (or plan to take on).

We assume that you’re already interested in generating more cashflow (duh) and have a couple of resources to help you out if you need more information.

Our suggestion is that you use DSCR to evaluate how much you should be borrowing. If your DSCR is too high, a smaller loan may be better for the health of your business in the long run.

At Bond Street, we believe financing a business should be simple, transparent, and fair. Reach out today or check your own rate in less than a minute.

Get Started