Applying for a loan should be simple, transparent, and fair. And we’ve worked hard to make the Bond Street application process as straightforward as possible.

Loan applications shouldn’t be a nightmare. That’s why you can expect to finish the application in 10-15 minutes, get feedback in 2 business days, and receive a final decision within one week.

Curious what it’s like to submit an application for a small business loan with Bond Street? Read on to see the entire process from A to Z.

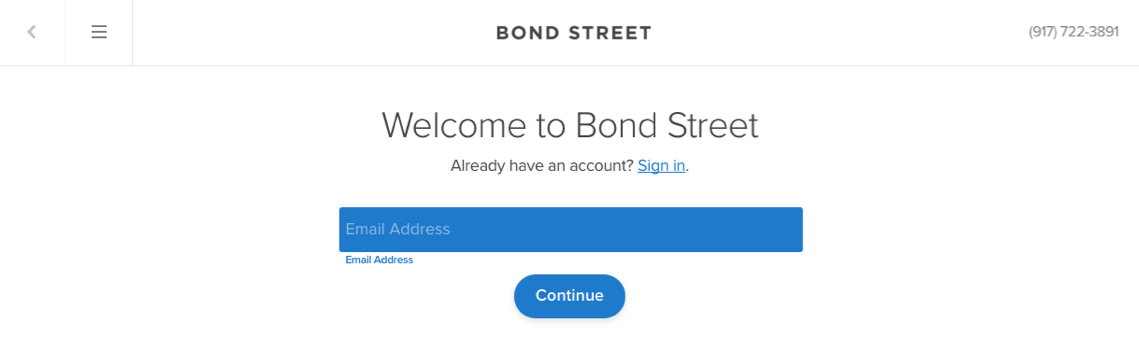

Step 1: Click “Get pre-qualified” to create an account

The first step to submitting a loan application with Bond Street is creating an account. If you have to pause the process at any time, you’ll be able to log in later without losing your information.

You can create an account and start your application by visiting bondstreet.com/apply or clicking the blue “Get pre-qualified” button on the Bond Street homepage at bondstreet.com.

Once you click the “Get pre-qualified” button, you’ll be prompted to enter your email address and create a password.

Step 2: Get Pre-Qualified

Now that you have an account, simply continue following the prompts to get pre-qualified for a small business loan.

Here’s the information you’ll need for this section:

- Basic personal information

- Basic business information (must be U.S. business at least 2 years old)

- Annual business revenue (must have at least $200K in annual revenue)

- Amount requested (up to $1 million)

- Years to pay off (1-3 years)

When prompted, you’ll fill out your:

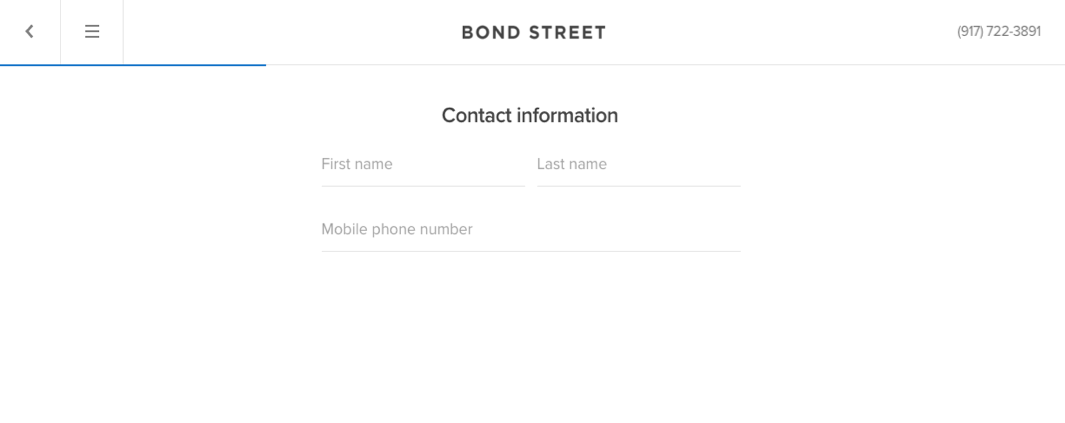

Part 1: Contact Information

Note: If you have questions during the pre-qualification process, you can message the Bond Street team by clicking the following icon in the lower right hand corner of the screen.

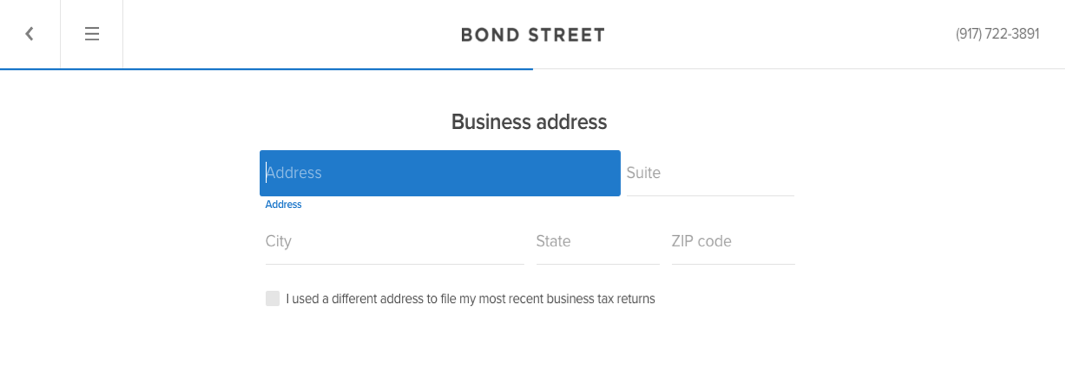

Part 2: Business Information

Part 3: Personal Information

In this section, Bond Street will request to access your personal credit report. This will not affect your credit score. After receiving your application, Bond Street will conduct a “soft pull” from the credit bureaus to obtain your personal credit score. Applicants with a score of 640 or higher are most likely to qualify, but credit scores are only one factor we consider.

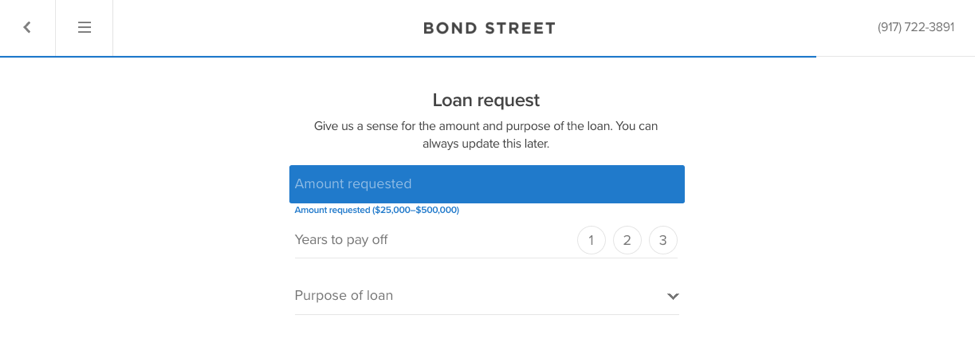

Part 4: Loan Request

Note: Before you apply for a loan, it’s important to know how much capital you need, what purpose it serves, and how long you’d like the repayment period to be. If Bond Street can’t approve you for the amount you’ve requested, they will counter-offer with a lower amount, if possible.

Next Steps

If your business is at least two years old and bringing in $200K or more in annual revenue, you’ll be prequalified for a loan of up to $1 million.

Next, get ready to fill out an equally easy application.

Step 3: Submit a Full Application

To complete a full application, you’ll need your:

- Tax EIN

- Income Statement (last two calendar years plus year-to-date)

- Cash Flow Statement (last two calendar years plus year-to-date)

- Latest Balance Sheet

Continue below to see each form. Remember that you can always exit and return to your application later by logging in to your account.

Part 1: Business Information

Part 2: Business Financials

In this section, you’ll share the following with Bond Street to help us make a sound decision about your loan application:

- Accountant’s information (if applicable)

- Business ownership structure

- Financial statements

- Read-only access to your bank account (optional)

Business Financials & Ownership

Financial Statements

If you use Quickbooks Online, we’re able to automatically create financial statements when you link your accounts. If you need help preparing financial statements yourself, visit our Quick Guide to Financial Statements. In the Guide, you can read about balance sheets, income statements and cash flow statements (as well as download free Excel templates).

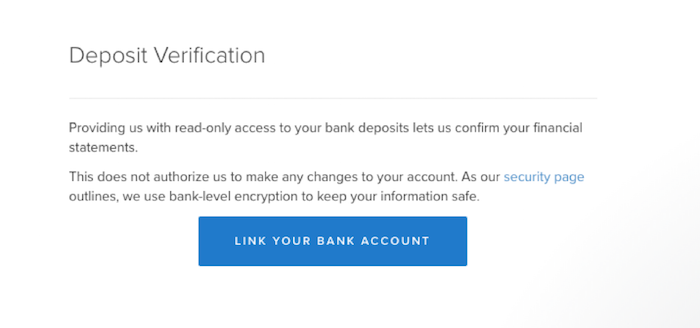

Link Your Bank Account

Link your bank account and Bond Street account so we can verify your financial statements.

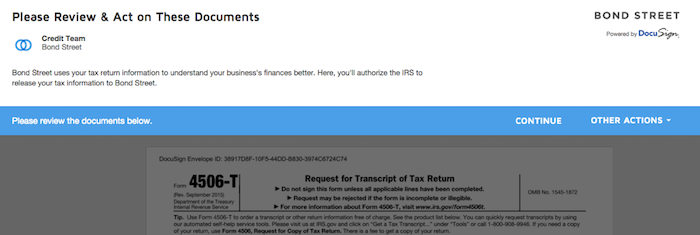

Part 3: Authorize Tax Information

In order to understand your business’ finances, we will request your tax return transcripts directly from the IRS. That means we need you to give us your SSN and electronically sign a 4506-T, or Request for Transcript of Tax Return.

Your data is safe with us. At Bond Street, we take your security and privacy seriously. That’s why we use bank-level encryption to keep your data safe and will never share your personal information without your written approval. Check out our Privacy Policy for more information.

In order to understand your business’ finances, we will request your tax return transcripts directly from the IRS. That means we need you to give us your SSN and electronically sign a 4506-T, or Request for Transcript of Tax Return.

Sign Your Tax Authorization Form Online

Submit your application!

Review the summary of your application to check that all the information you’ve entered is complete and correct.

Then simply submit by clicking the blue button at the bottom of the page!

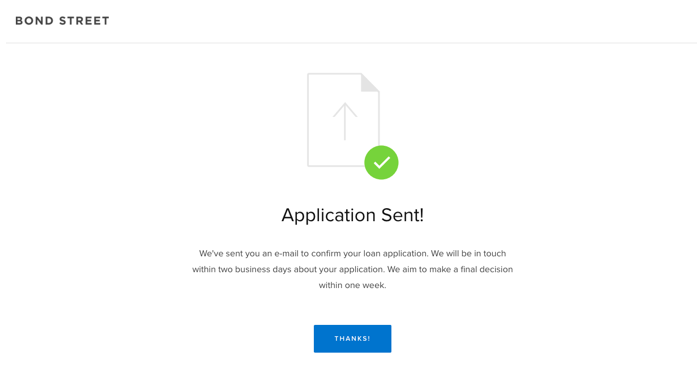

By clicking “Submit application,” you’ve taken a big step toward growing your business. Simply pre-qualifying for a small business loan and putting together an application is a milestone in the journey of any small business owner.

What’s next?

After submitting your small business loan application with Bond Street, you’ll receive a confirmation email with a summary of your application.

The expert Bond Street team will review your application and reach out to you within 2 business days. You can expect to receive a final decision within 7 days. While you can’t go back and edit your application, you can attach additional files to it by logging in to your Bond Street account at any time.

Next stop: business growth!

Got more questions?

- Visit our FAQ page.

- Visit our Small Business Resource Center.

- Email our customer service team at support@bondstreet.com.

- Call us at (917) 722-3891.

At Bond Street, we believe financing a business should be simple, transparent, and fair. Reach out today or check your own rate in less than a minute.

Get Started